Safeguard your Pension and Health Card benefits when Covid concessions come to an end in 2024 January 19th, 2024

Discover the impact of changing Centrelink deeming rates on Aged Pension payments and Commonwealth Seniors Health Card holders. Learn strategic approaches to minimize financial repercussions and take advantage of special concessions through Centrelink Friendly Income products.

Some Netplan fans are likely to see significant reductions in Aged Pension payments when the last of the Covid concessions expires in July this year.

It is also likely to affect some people currently holding a Commonwealth Seniors Health Card or CSHC.

The good news is that there’s still time to minimise the impact and take advantage of special concessions available through Centrelink Friendly Income products.

Centrelink’s frozen deeming rates are likely to increase substantially when a two-year freeze expires on July 1.

This will affect existing income-tested part-pensioners but is likely to spill over to some pensioners currently receiving a full pension or those affected by the Asset means test.

Why Centrelink's frozen deeming rates coming to an end might impact you

As you know through Netplan Session 4 for singles, a deemed interest rate of 0.25 percent currently applies to the first $60,400 of financial assets and then 2.25 percent for the total above this.

For couples, the combined financial asset amount for the lower deeming rate is $100,200. Above this, the 2.25 percent applies.

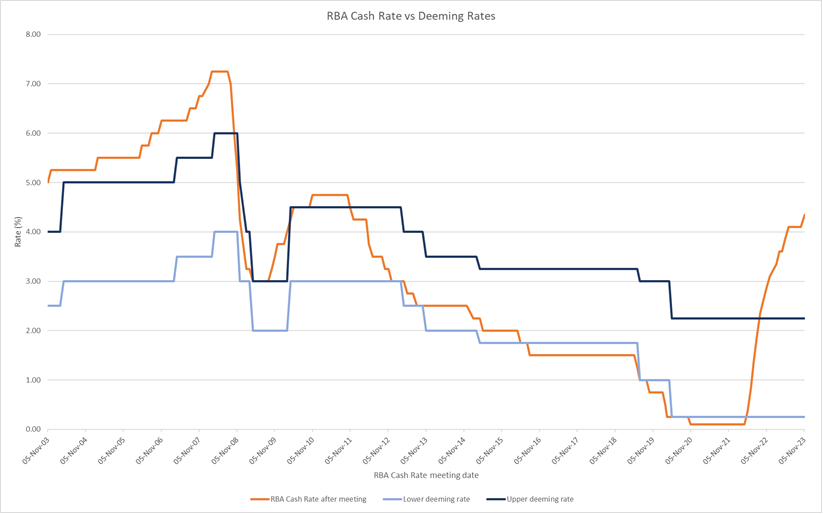

While not directly linked to the RBA’s overnight cash rate, the RBA cash rate flows through to other interest rates and would be a determinant in setting future deeming rates.

The RBA cash rate when the deeming rates were frozen in 2022 was 0.35 percent. Currently, the cash rate is 4 percent higher at 4.35 percent.

The last time the RBA cash rate sat around these levels was 14 years ago in 2010.

Deeming rates for the lower threshold at that time were 3 percent and 4.5 percent for the higher amounts.

This chart shows the relationship between the RBA Cash Rate and the deeming rates.

Financial assets used in the deeming calculations include all bank accounts, cash, bullion, shares, managed funds, superannuation funds, account-based pension funds and amounts gifted above the gifting limits.

The grand total is multiplied by the deeming rates to calculate a per-fortnight amount that is tested against Centrelink’s income-free area. For singles, that is currently $204 a fortnight and for couples, a combined $360.

Example 1

For example, a single homeowner with $350,000 in financial assets would currently see their entitlement to a full-age pension of $1,096.70 a fortnight reduced by $26.21 a fortnight because of the income test effects.

If the deeming rates returned to the 2010 levels, the reduction per fortnight would jump to $183.46 per fortnight or a whopping $156.65 dent in their existing fortnightly payments from Centrelink.

Commonwealth Seniors Health Card holders

Netplan fans who are holders of the Commonwealth Seniors Health Card (CSHC) might also be affected.

Under the CSHC income test rules, taxable income counts towards the cut-off limits which for singles, is $95,400 per annum and for couples a combined $152,640. Financial assets such as superannuation are not included in this figure, including withdrawals, with one exception.

To determine eligibility for the CSHC, the account balance of account-based pensions is deemed to be earning a certain rate of income which is included in the CSHC calculations.

With the frozen deeming rates, this is all but irrelevant at the moment but, if they change in July, the deemed income from an ABP could affect your entitlements.

Example 2

For example, an individual with $800,000 in an ABP currently has a deemed income of $16,792 attributed to the ABP in the card entitlement calculations. If the deeming rates changed to the 3 percent and 4.5 percent levels of 2010, the increased deemed income would be $35,094. Still not enough to have them kicked off but less room for other income from say, a part-time job or investment property rent receipts.

Minimising the impact

One option to minimise the impact of any changes for both pensioners and CSHC card holders may be to make use of special Centrelink-complying income streams. They also benefit from the current high-interest rates on offer.

Typically sold as a lifetime annuity, these products combine guaranteed indexed income payments for life with generous Centrelink concessions.

Financial planners typically combine these products with conventional income-paying investments like account-based pensions to provide a blend of certainty and flexibility in structuring retirement portfolios.

Irrespective of the investment returns, 60 percent of the payments actually received, count towards the income test.

Only 60 percent of the invested amount is included in the Centrelink asset test. Once the person reaches 84 years of age, that drops to just 30 percent. If you are close to 84 or over, the value drops to 30 percent once it has been in place for 5 years.

This can also make a big difference to the assessed amount used in age care calculations as well.